America faces a debt crisis, and while adults struggle to dig out of it, we also need to find a way to prevent it from growing further. Could a key to preventing a growing debt be teaching financial literacy in schools?

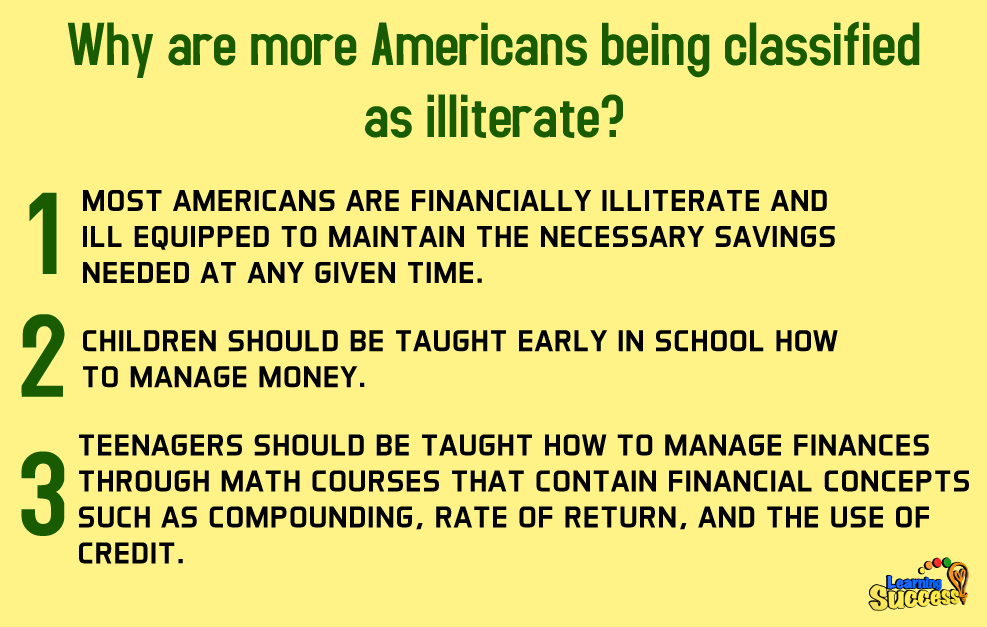

More Americans are being classified as financially illiterate

According to official reports, less than 50% of Americans have money in a savings account or have any type of retirement plan. This means a huge chunk of the country is completely unprepared for a financial disaster, unable to handle a crisis without borrowing money or selling their belongings.

Currently, American adults are just not very well-versed in money management. But we can stop this trend for the new generation by giving them better instruction, and making sure children now start learning about personal finance early.

The solution to the growing debt problem

While parents should certainly start teaching their children finance from an early age, schools must also start including financial responsibility in their curriculums.

While finances seems like it would be a hard subject to make appealing to children, it's actually possible! There are a number of math games and strategies teachers can use, which make the learning not only fun, but also realize the importance of being financially literate.

Practical experience through practice situations

Some of these strategies are detailed in the ebook Toddlers to Teens: Raising Financially Responsible Kids. The book suggests details for all age ranges -- for younger children, for example, let them use coupons during grocery shopping trips.

As they get older, let them sit in on and participate in bank transactions. And finally, once they're in their teens, give them a prepaid card. This can prepare them for what it would be like to use a debit/credit card.

The most important thing to remember is to continually teach a child why they should learn about money. Parents and teachers should teach children with the goal of making them learn consequences, and how debt can ruin their finances. This way, they're motivated to learn specifically to avoid debt.

Key Takeaways:

Beyond finances, if you or someone you know is having difficulty with math, then Learning Success System can help you find which micro-skills need strengthening and increase learning ability -- take our free assessment here!

Do You Need help with a Math Difficulty?

Our simple online analysis will help you get to the core of the problem and find the right solution for you.

Understanding how to help someone with a learning difficulty starts with understanding which micro-skills are affected. When you learn which of the micro-skills is the problem, you will then be on your way to solving it.

You'll also learn how to:

- Build confidence

- Enhance Learning ability

- Eliminate avoidance

- Build grit

You can get this analysis for free by filling out this simple form. This will help you get to the bottom of a learning difficulty and provide you with a solution. If you are ready to put this problem behind you click the button below and fill out the form.